Raise your hand if you would rather use your card versus cash for purchases. According to 2020 statistics compiled by Fundera, 80% of consumers prefer spending with a card opposed to cash. Out of the 80%, 54% prefer debit cards and 26% would rather use credit cards. It’s a no-brainer why most of us choose convenience, especially when it comes to simply swiping our card at the store or entering our information online to purchase items or pay our bills.

Paying is so quick that most of us have probably never thought twice about what actually happens behind the scenes. It seems like our transactions are magically approved, and we go about our day. But it’s not quite that simple. After you swipe your card or submit your online payment, your card has to be approved as valid and as having the funds needed for your purchase. This approval process is called credit card authorization, and there are several steps that are completed on the backend to make your purchases possible.

Let’s explore the process a little further using PUBLIQ Software’s online bill pay, which is used by our customers to accept utility and property tax payments from their communities.

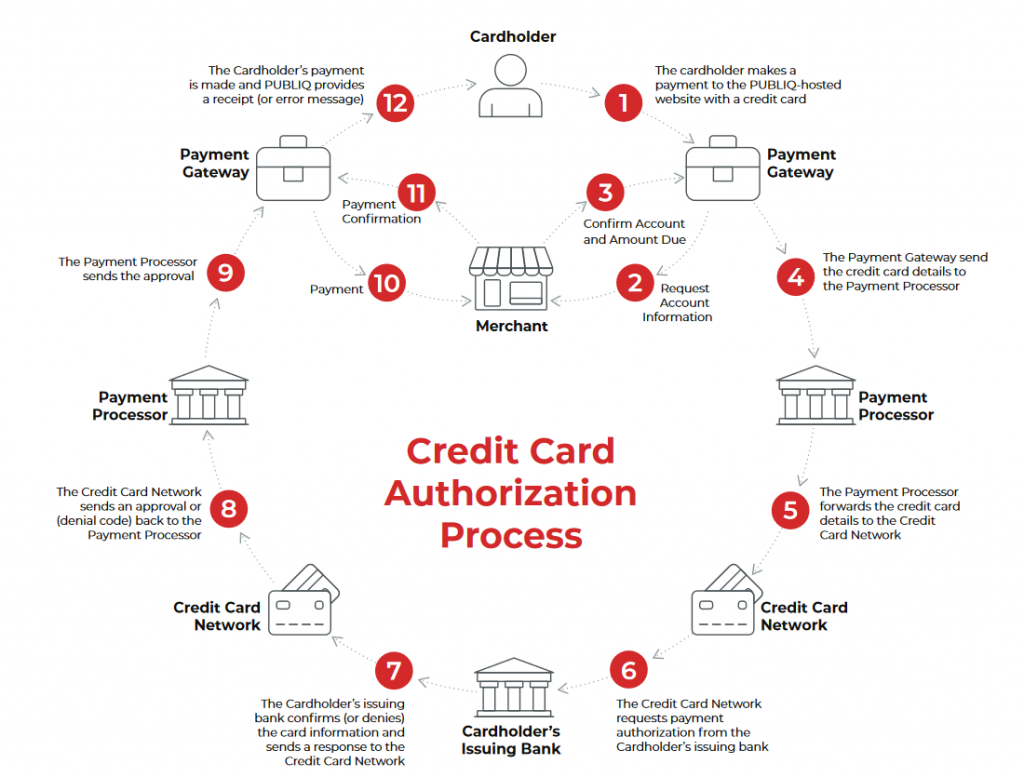

Here’s how it works

1. The cardholder makes a payment to the PUBLIQ-hosted bill pay website.

2. The card information is sent securely through a payment gateway to the merchant for confirmation.

Payment Gateway: A service that helps authorize payments by connecting the payment processor and merchant account to the card company. Basically, it connects your financial account to the business’s merchant account.

3. The merchant approves the account is valid and has the sufficient amount and communicates back to the payment gateway.

Merchant (or Merchant Account): A special account where funds are held before being transferred to a regular bank account.

4. The payment gateway sends the card details to the payment processor.

Payment Processor: An entity that manages the transaction process by acting as the mediator between the merchant and the financial institution. A processor can also authorize transactions and assist with the transfer of funds.

5. The payment processor forwards the card details to the credit card network.

Credit Card Network: Networks, such as Visa®, Mastercard®, Discover®, and American Express®, that control where cards are accepted and facilitate transactions between merchants and credit card issuers. They also set the processing fees that merchants must pay to accept card transactions.

6. The credit card network requests authorization of the payment from the cardholder’s issuing bank.

Issuing Bank: A financial institution that provides cards to consumers on behalf of card networks, such as Visa and Mastercard. They are also in charge of the consumer’s account and financial information.

7. The issuing bank then either approves or denies the card information and sends the response to the credit card network.

8. Depending on the status, the credit card network sends either the approval or denial code back to the payment processor.

9-11. If the purchase is approved, the payment processor sends the payment back through the gateway to the merchant for confirmation.

12. The payment is successfully completed and PUBLIQ sends a receipt. If the payment is denied by the credit card network, PUBLIQ sends an error message notifying the cardholder.

Source: fundera.com/resources/cash-vs-credit-card-spending-statistics